Energy efficiency improvements can be expensive and burdensome for residential homeowners, renters and building owners. Luckily, there are an increasing number of financial options to help cover the up-front costs of efficiency upgrades. Below, we lay out several financing options to make our homes and workplaces more energy efficient.

1. On-Bill Financing

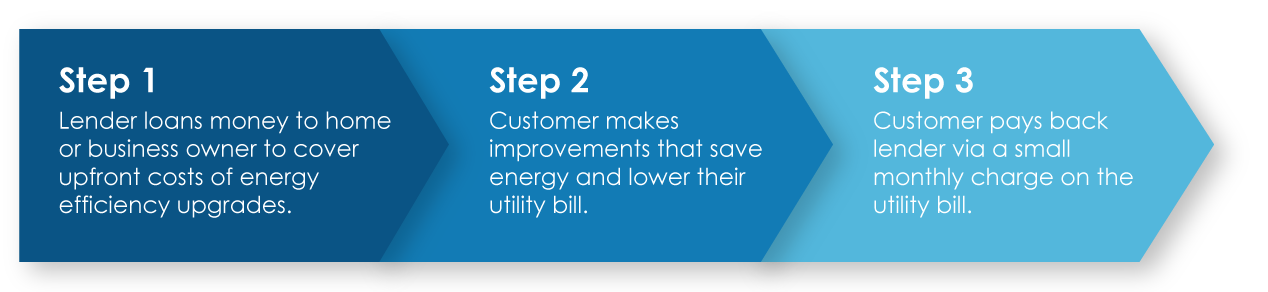

On-bill financing is an umbrella term for a financing program where a charge is added to a customer’s energy bill to repay a loan from a utility for energy efficiency upgrades. The utility acts as the lender and incurs the upfront costs of the improvements.

How It Works

Throughout MEEA’s territory, there are nine states with active on-bill programs, pilot program or programs in the planning process: Illinois, Iowa, Kansas, Kentucky, Michigan, Minnesota, Missouri and Nebraska . There are many different types of programs, with no two exactly alike. The program can be run as a loan, tariff or service agreement, and can serve residential or commercial customers.

2. PACE Financing

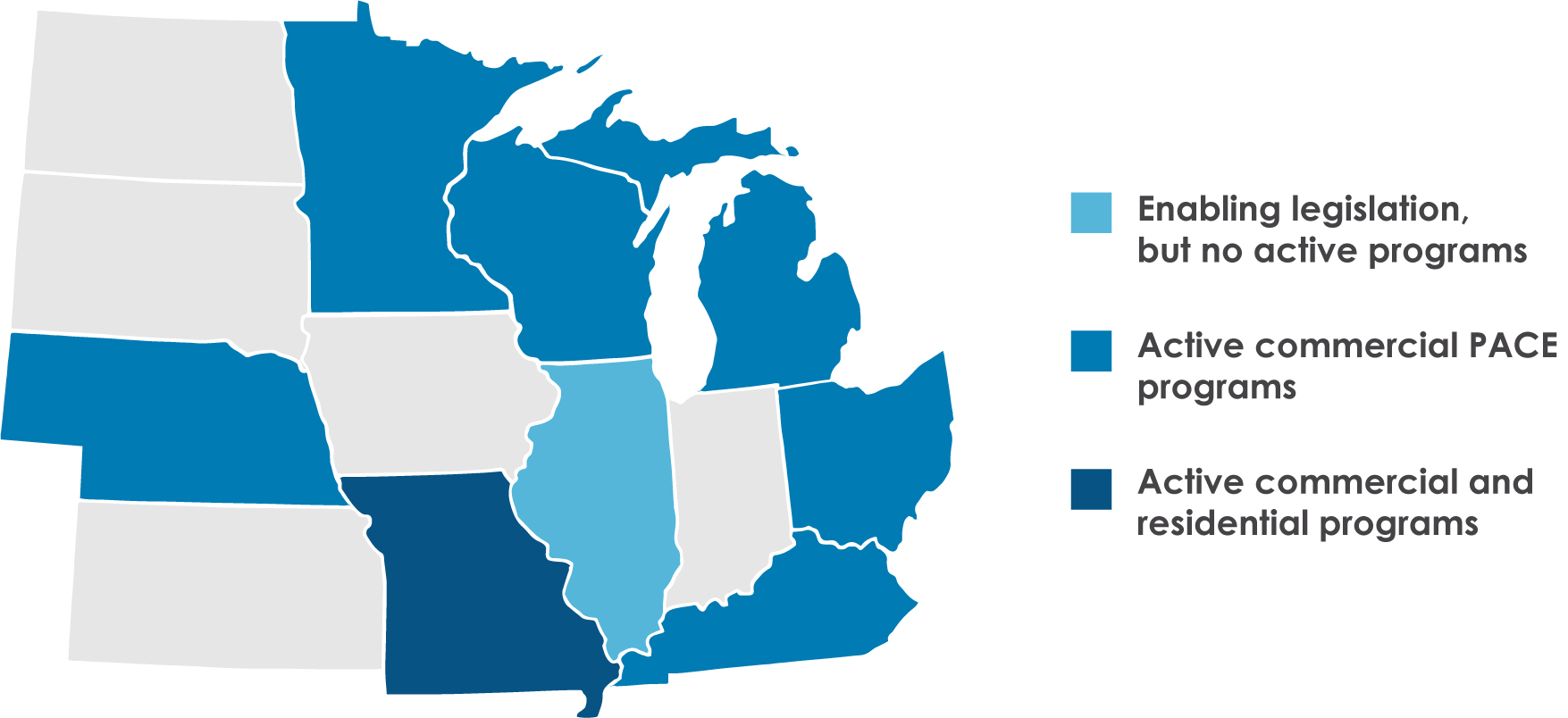

Property Assessed Clean Energy (PACE) financing enables property owners to finance efficiency upgrades through private lenders. The loan is then repaid through a special assessment on the property’s tax bill. Across the nation, there are both active residential (R-PACE) and commercial (C-PACE) programs. More than 20 states across the nation have active C-PACE programs, and three states have active R-PACE programs.

Status of PACE Programs in the Midwest

Apart from traditional commercial buildings, C-PACE can be used to finance multifamily residential buildings. Although C-PACE can be used for efficiency improvements on multifamily properties, such use has been limited. In the Midwest region, there are only three examples of funds being used for multifamily projects. Two of these are in Michigan and were financed through Lean and Green MI. The third project is in Kentucky and was run through KY PACE. There is plenty of room for improvement and uptake, particularly within the affordable housing sector. Although the use of PACE in multifamily has been limited, it is even more limited for affordable multifamily.

Want to learn more about PACE financing? Read our new fact sheet.

3. Underwriting

Underwriting energy efficiency into a mortgage, when purchasing or refinancing a property, allows for the financing of efficiency upgrades with mortgage capital. Underwriting projected energy savings allows for additional funds from the loan to finance the efficiency improvements and also reduces the need for public subsidy dollars for affordable multifamily properties. Multifamily property owners benefit from underwriting with access to low-cost and long-term capital, better loan terms, marketability and retention.

4. Fannie Mae and Freddie Mac

In 2016, the Federal Housing Finance Agency issued the Duty to Serve rule, which directs Fannie Mae and Freddie Mac to improve access to mortgage financing for under-served markets. Freddie Mac and Fannie Mae have complied with the rule by increasing financing options for energy efficiency improvements for affordable single-family and multifamily homes. Freddie Mac released a variety of energy efficiency financing options under Green Advantage, that strive to reduce water and energy use by 15% and invest at least $350 per unit. Aside from providing finance options, Fannie Mae also plans to create a whitepaper to educate stakeholders on best practices in energy efficiency financing and affordable housing preservation, which will be published in 2020.

5. USDA

The Energy Efficiency and Conservation Loan Program from the U.S. Dept. of Agriculture provides loans to finance energy efficiency and conservation projects for commercial, industrial and residential properties. Through this program, utilities in rural areas can borrow funds, tied to Treasury rates of interest, and re-lend for projects within their service territories. Utilities can use these funds to set up on-bill financing programs, to modify the electric load to reduce the demand on the overall system, improve efficiency and reduce peak demand.

6. Missouri Linked Deposit Program

The Missouri Treasury Department runs the linked deposit program, which provides low-interest loans to help expand Missouri’s economy. There is a total of $720 million available for loans. Of this $720 million, $20 million goes to the Multi-Family Housing Program and $110 goes to the Small Business Program. Eligible projects include the purchase and rehabilitation, construction, renovation and land development of multifamily properties. Energy efficiency upgrades are eligible for the program.

Contact Us

Are there other energy efficiency financing options we should include on this list? Let us know by contacting Sophia Markowska at Smarkowska@mwalliance.org.

Links and Resources

- MEEA Fact Sheet: PACE Financing

- DOE: On-Bill Financing

- ACEEE: EE Financing

- Community Conservation Cooperation: Underwriting Efficiency

- PACENation

- Commercial PACE for Affordable Multifamily Housing

Editor's Note (11/5/18): an earlier version of this blog listed Wisconsin as a state with an on-bill financing program. It does not have on-bill financing.